portability of estate tax exemption 2019

Two important aspects to remember are that the portability exemption is only available to married couples and only applies to Federal estate taxes. As of 2021 the federal estate tax exemption is 114 million.

Federal Estate Tax Portability The Pollock Firm Llc

When enacted it was meant to apply only to estates of decedents dying before January 1 2013.

. Portability of Estate Tax Exemption. You will want to be aware that portability may not be the right decision for your situation if for example you choose to divide. Understanding the portability of the estate tax exemption is crucial to ensuring your spouse has a clear understanding of how portability works.

The TCJA doubled the estate and gift tax lifetime exemption from 549 million per taxpayer to 1118 million per taxpayer. The 2019 Washington State exemption for estate taxes is 2193 million per person. How does the Federal Estate Tax Exemption work.

The portability rules provide for the transfer of a deceased spouses unused estate tax exemption deceased spousal unused exclusion amount or DSUEA to a surviving spouse without inflation adjustments. Estate Tax Return IRS Form 706. Portability Federal Estate Tax Exemptions.

However when one spouse. This is of course a much lower threshold so many more people in Illinois will find that their estate is subject to the Illinois estate tax while not being subject to the Federal estate tax. In 2010 the top estate tax rate was decreased from 55 to 35.

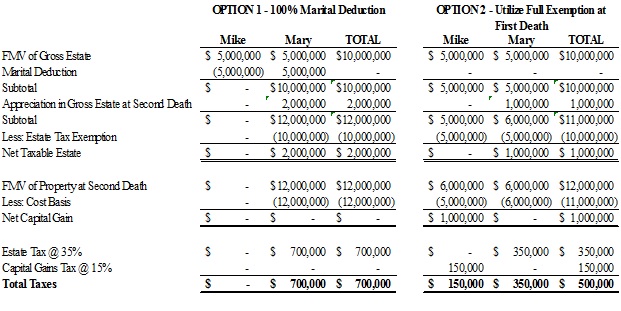

It increased again to 35 million in 2009. Had Nicks estate plan placed 525 million in a credit shelter trust Noras estate would have avoided tax on its appreciation in value 525 million for an estate tax savings of 21. You see prior to TRUIRJCA estate planning was focused in no small part on having married couples divide up ownership of assets so each spouses estate could fall.

The estate of an NRA has only a 60000 not 11400000 estate tax exemption available and no gift tax exemption. The option of portability can make a significant difference when it comes to taxation of an estate. Electing to use estate tax portability makes a significant difference in your federal estate tax liability.

Estates in excess of the exemption amount must file an estate tax return and taxable estates above the exemption amount are subject to a 10 20 tax on all. In 2022 you will be taxed if the total of the gross assets at hand exceeds 1206 million. Note that with regard to state estate taxes currently only Hawaii offers portability at the state level and Maryland will begin offering portability of its state estate tax exemption at the beginning of 2019 for decedents who die on or after January 1 2019.

Further married couples can utilize what is known as. Good news came for taxpayers with large estates when the Tax Cuts and Jobs Act TCJA was passed. The exemption is 11400000 for 2019 and is indexed for inflation.

In reality very few estates will pay estate tax. For 2019 the exemption has been adjusted for inflation to 114 million per taxpayer and 228 million per married couple. This is done by filing an US.

The estate tax is a tax on an individuals right to transfer property upon your death. A married couple can transfer 2412 million to their children or. Noras estate is subject to tax on 295 million 40 million less her exemption and Nicks exemptions for a tax liability of 118 million.

It is more polite to refer to this as the portability election The unused exemption may be used by the surviving spouse for both gift and estate tax purposes in addition to the surviving spouses own exemption. The NYS estate tax exemption is very different. Portability can be used to protect the surviving spouse from having to pay steep gift or estate taxes upon a spouses death.

What Does Portability of the Estate Tax Exemption Mean. The exemption is in fact indexed annually for inflation so it does increase over time. The federal tax exemption in 2020 was 114 million which leaves 86 million subject to 40 tax without portability rules.

However now portability is permanent and it can have more of an impact. Donees of gifts from NRAs or foreign estates in excess of 100000 or 16388 in 2019 inflation adjusted from a foreign corporation or partnership must report these gifts to the IRS on Form 3520. When Mark dies in 2020 his estate is still worth 20 million since he inherited 100 of the rights to the assets upon Joans death he must pass down an estate worth 20 million.

The portability of unused estate tax exemption is allowed for persons dying on or after January 1 2011. State Estate Tax Exemption. This piece of legislation named the Tax Relief Unemployment Insurance Reauthorization and Job Creation Act TRUIRJCA introduced the portability feature to the federal estate tax exemption.

The federal estate tax exemption and gift exemption is presently 1206 million. Historically speaking estate tax exemptions and estate tax portability have undergone multiple changes since the year 2000 when the exemption amount hovered at 675000. The exemption is subtracted from the value of estate assets with the result being subject to the estate tax.

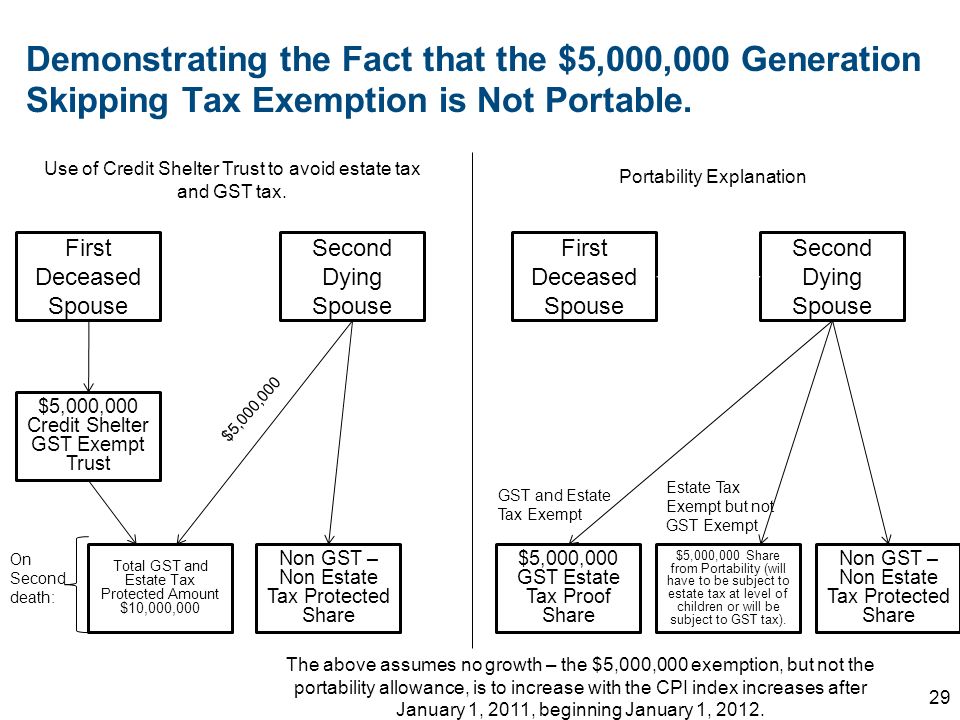

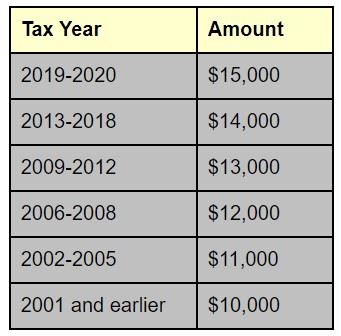

Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013 5340000 in 2014 and 5430000 in 2015 federal estate tax exemption then the surviving spouse can make an election to pick up the. It should also be noted that Illinois estate tax does not have portability meaning that the second to die spouse cannot use. With portability any unused estate tax exemption of the first spouse to die can be carried over to and used by the surviving spouse for federal gift and estate tax purposes.

It is recommended that individuals and couples with substantial assets create an estate plan with the help of an attorney to help them minimize their federal tax liability. Thus if a 2019 decedents taxable estate is not more than. In 2002 the exemption was increased to 1 million.

The Illinois estate tax exemption amount remains at 4 million. The Tax Relief Unemployment Insurance Reauthorization and Job Creations Act of 2010 introduced for the first time the concept of portability of the federal estate tax exclusion between spouses. The surviving spouse must elect to capture the DSUEA.

This exclusion amount can help many people avoid the estate tax which can be as high as 40 on amounts over 11180000. Currently the limit is set at 1158 million in combined assets for a decedent who dies in 2020 and is expected to remain at this level until at least 2025. Each year the government sets a tax exemption limit or exclusion amount for estates under a certain size.

The federal estate tax exemption and gift exemption is presently 1206 million. Washington State does not offer a portability election similar to that under the federal estate tax regime. A married couple can transfer 2412 million to their children or.

How To Advise Your Clients Under The New Estate Tax Law Ppt Download

Portability How It Works For Estate Tax Batson Nolan

Word Tax With Clock On The Office Workplace Business Concept Getty Images Tax Deductions Capital Gains Tax Irs Taxes

Mastering Portability Ultimate Estate Planner

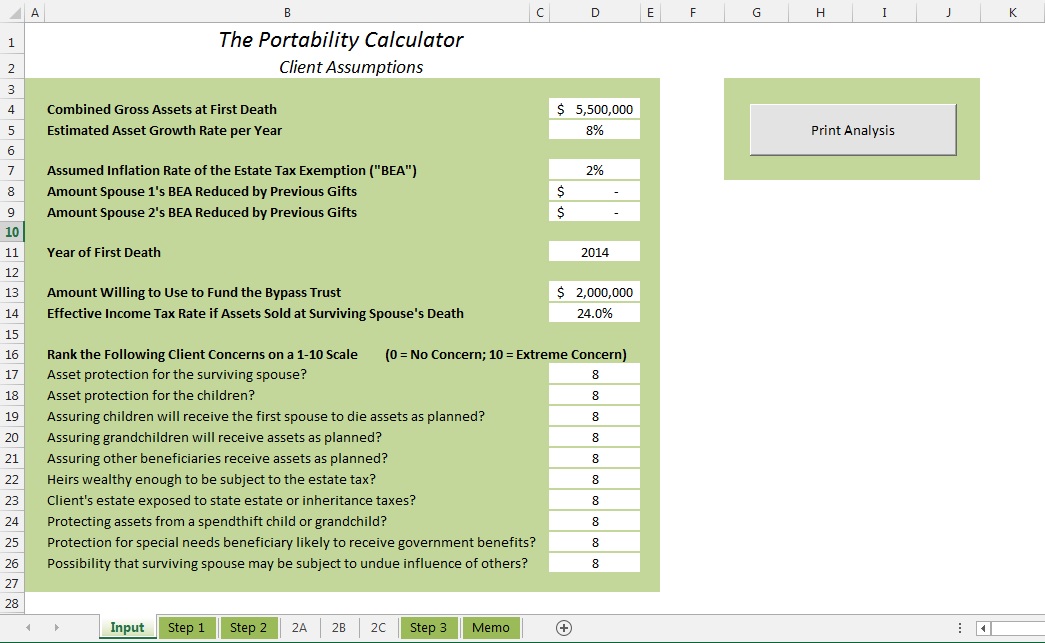

The Portability Calculator Ultimate Estate Planner

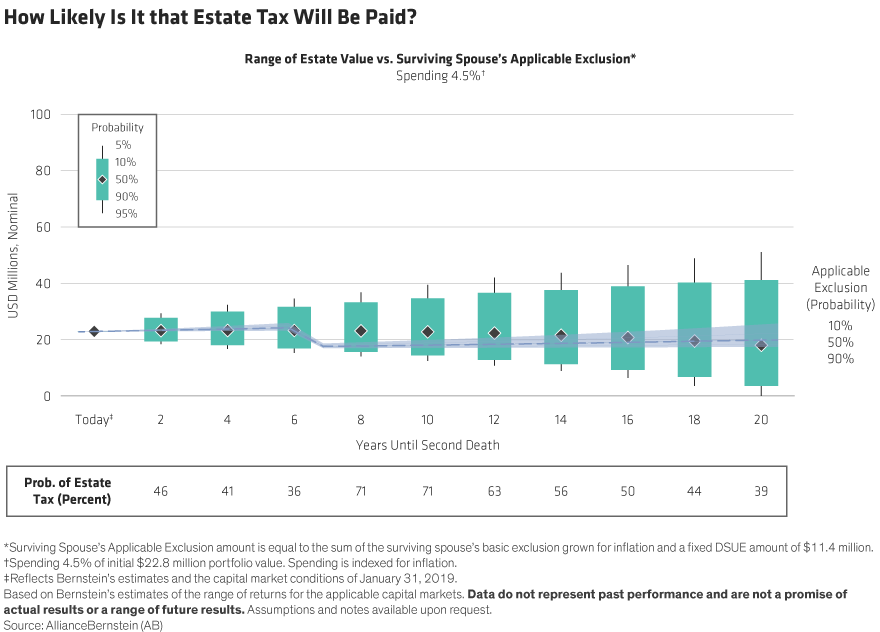

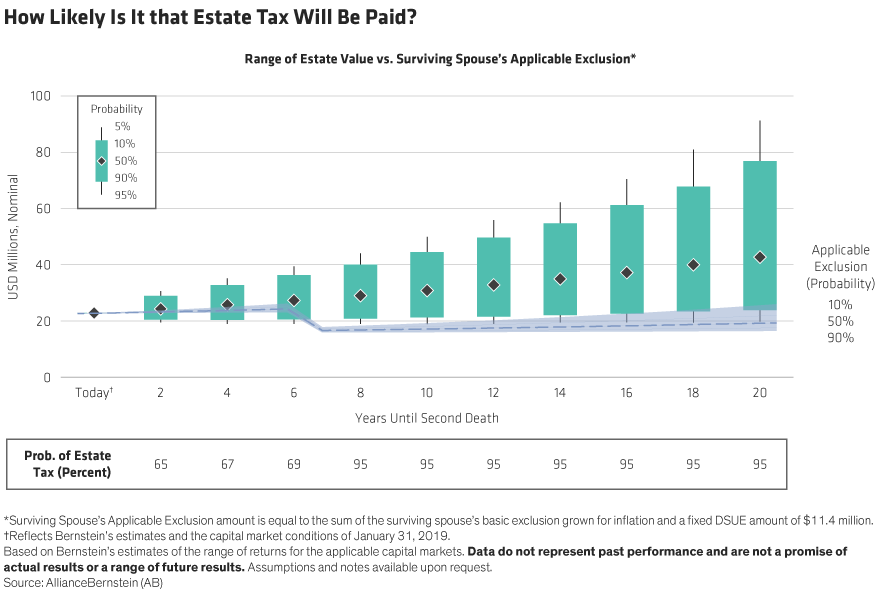

Will Your Estate Be Taxable In The Future Context Ab

Estate Tax Portability What It Is And How It Works

Portability Of The Estate Tax Exemption Cdh Law Pllc

Will Your Estate Be Taxable In The Future Context Ab

750 Tax Pictures Download Free Images On Unsplash

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

Estate Tax Portability Preserving It For The Benefit Of Your Heirs

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Estate Planning With Portability In Mind Part Ii The Florida Bar

Portability Enabled Traditional Trusts Clark Trevithick Full Service Boutique Law Firm In Los Angeles California Southern California

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One